Core Points of the Interview:

The success of the dry process hinges not merely on stacking equipment but on systemic innovation where materials, processes, and equipment are tightly interlocked.

While most firms aim to achieve completion, Tsingyan Electronics pursues perfection. Electrode quality is ultimately determined by the choice of process.

Tsingyan Electronics targets limiting areal density fluctuation in dry-film formation to ≤3%, rivaling the top-tier precision of wet coating machines.

Next-generation battery technologies—especially solid-state batteries—are almost certainly destined to adopt the dry process.

2027 will mark the “inaugural year” for the industrialization of dry electrodes, with widespread mass-production line deployments expected

The thirst for process and equipment innovation in the lithium battery industry has never been as urgent as it is today.

Battery companies are racing to implement new technologies such as large cylindrical and solid-state batteries, driven by the core motivation to win market share and even challenge or disrupt the existing market order.

In this transformation, innovation in processes and equipment serves as the indispensable bridge connecting "new technologies" and "new markets," with dry electrode processes at the forefront increasingly becoming the focal point.

Taking solid-state batteries as an example, many players have progressed beyond selecting technical routes and verifying material systems, now facing the critical inflection point of engineering and scaling up.

However, as Guoxuan High-Tech recently revealed, even preparing production lines for semi-solid-state batteries requires far more than minor adjustments to existing wet processes; the necessary additions, replacements, or overall modifications exceed initial expectations.

For large cylindrical batteries, the application of dry processes has entered a crucial period of tackling challenges and pursuing ultimate yield rates.

The advantages of dry processes are clear and disruptive: eliminating solvents directly brings significant cost reductions and environmental benefits; it enhances electrode compaction and energy density, and naturally adapts to solid electrolytes, aligning with the pace of battery technology iteration.

Simultaneously, by integrating multiple wet-process steps—such as mixing, slurry preparation, coating, drying, and calendaring—into a more streamlined and unified workflow, it achieves substantial simplification, directly translating into major reductions in production and investment costs. This mirrors the underlying logic behind Tesla's adoption of the process in its 4680 production line based on 'first principles'.

Attracted by this prospect, from mass production of large cylindrical batteries to engineering explorations for solid-state batteries, a growing number of equipment enterprises are flooding into the dry-process track, offering solutions ranging from single machines to complete lines.

Questions thus arise: What are the true standards for measuring the strengths and weaknesses of the dry process? Is it still a "futuristic" technology with fulfillment far off?

Especially in key areas such as large cylindrical dry cathodes and sulfide solid-state electrolyte membranes, the scaling pace of the dry process appears slow. This inevitably prompts the market to ask: When will the true breakthrough point for the dry process arrive? And how should expectations be reasonably set?

To answer these questions, perhaps we need to turn our attention to one of the earliest explorers in the industry—Tsingyan. The company has demonstrated three distinct core advantages that place it at the forefront of this technological race:

First, deep technical origins: Incubated from the Shenzhen Tsinghua University Institute, with years of accumulation in solvent-free dry powder film-forming material technology centered on powder film-forming technology.

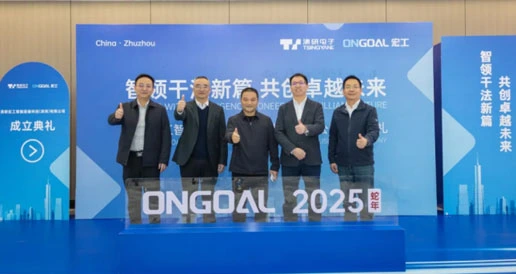

Second, top-tier industrial collaboration: Targeting the two core stages of dry electrode production—mixing and film formation—it has established joint ventures with Honggong Technology and Naknor—TSINGON and TSINGYANAK—respectively, and has deeply collaborated with material leader BTR for joint development, integrating top-tier resources across the industrial chain.

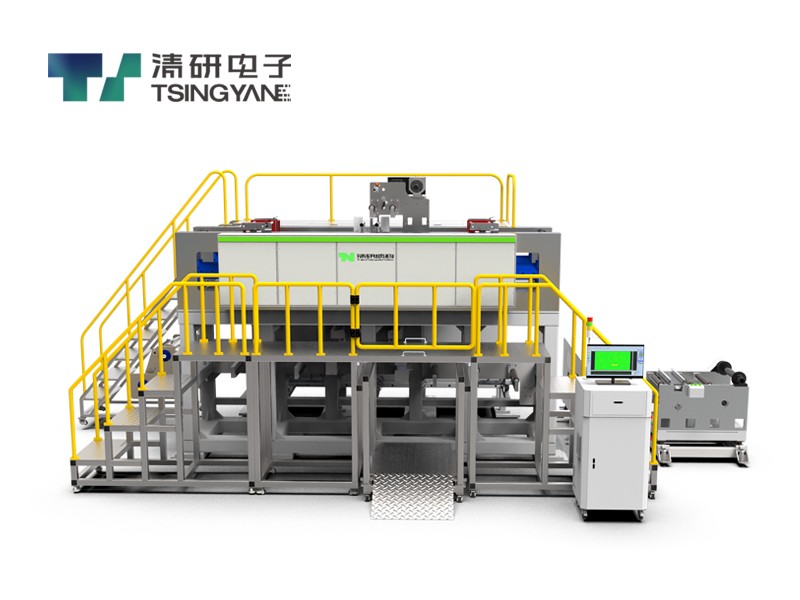

Third, leading scale validation: China's first fully automated 0.1GWh dry electrode integrated production line commenced operation in April 2025, with plans to achieve 5GWh capacity by 2026.

Based on this, Gaogong Lithium conducted an in-depth dialogue with Dr. Wang Chen, Chairman of Tsingyan, aiming to explore the current technological status, industrialization path, and future prospects of dry electrodes.

The following is the transcript of the exclusive interview:

Gaogong Lithium: The commissioning of Tsingyan's first fully automated 0.1GWh dry electrode integrated production line in April is undoubtedly a significant milestone. Which quantitative indicators demonstrate its breakthrough nature?

Dr. Wang Chen: The breakthrough of this production line lies in the collaborative optimization of the front and back segments.

First, in the front-end mixing and homogenization stage, our joint venture with ONGAOL Technology—TSINGON—after over a year of refinement, has increased the core metric—material discharge rate—to 99.5%. This far surpasses the industry's typical level of around 95%.

Discharge rate directly impacts batch stability and formulation accuracy, serving as the key to enabling continuous automated production and preventing cross-contamination. Previously, this issue was less prominent with standalone equipment, but for integrated processes, it becomes fundamental.

Second, in the back-end powder film formation stage, the equipment developed by TSINGYANAK—the joint venture between Tsingyan and Naknor—has advanced to its second generation.

The first-generation equipment addressed the "from nothing to something" challenge, demonstrating the feasibility of dry film formation. The second generation focuses on elevating "from something to excellence," with its core mission being to enhance areal density uniformity.

Significant progress has been achieved in both the machine direction (MD) and transverse direction (TD), targeting areal density fluctuations within 0.3%—a benchmark that rivals the leading standards of wet coating machines.

Founder Of Tsingyan: Dr. Wang Chen

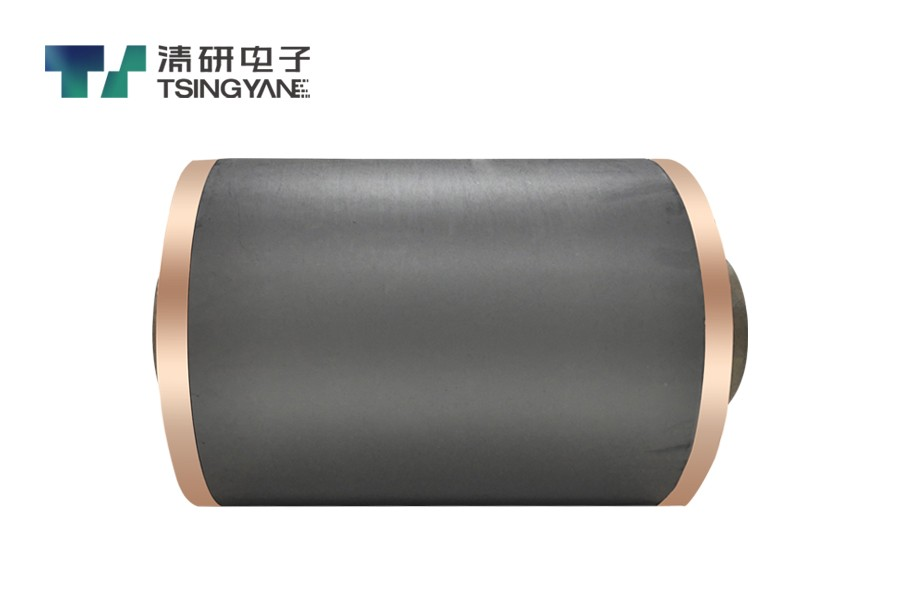

Gaogong Lithium: The dry electrode diaphragms of Tsingyan Electronics are renowned for their features of "high strength, large width, and adjustable thickness". In the 0.1GWh production line, how are these core parameters stably reproduced?

Dr. Wang Chen: Stability manifests in multiple dimensions:

Width & Speed:

Current: Stable 800mm width, anode double-sided film speed >80m/min, cathode at 50m/min.

Future: 1.2m width in mass production.

Thickness Control (Key Breakthrough):

Achieved ultra-thin 30μm films with ±2μm precision via roller gap/pressure calibration.

Material-agnostic (covers ternary and challenging LiFePO₄ cathodes).

Gaogong Lithium: Remarkable! Is 30μm achievable for all materials, including difficult-to-process LiFePO₄?

Dr. Wang Chen: Yes, it includes NCM materials and lithium iron phosphate. Among them, lithium iron phosphate is indeed the most challenging.

The key to achieving this lies in adhering to the positive collaborative development of materials and processes. We have carried out a large number of modification works on both the main materials and binders, and it is by no means simply using the existing wet-process materials provided by customers. This must be a process of in-depth combination.

At the same time, Tsingyan Electronics has also pioneered and implemented the process concept of "gradual thinning" - first forming a film from the powder, then precisely thinning it step by step, and finally conducting thermal compounding. This has become the mainstream route of the dry process in the industry.

What the company is currently working on is how to ensure the ultimate uniformity of the gradual thinning in the TD direction under a larger width (such as 800mm), which requires very comprehensive technical strength.

Gaogong Lithium: You mentioned material synergy. Currently, power batteries are advancing toward ultra-fast charging and higher specific energy, with new materials like high-density lithium iron phosphate, lithium-rich manganese-based cathodes, silicon-carbon anodes, and lithium metal anodes emerging constantly.

How does Tsingyan's dry electrode solution ensure compatibility with such rapid iteration and compete with mature wet processes, especially on critical metrics like compaction density?

Dr. Wang Chen: Our ultimate mindset is to align the production efficiency and performance metrics of dry processes comprehensively with—or even surpass—wet processes. Material system adaptability is no exception. While the industry pursues high compaction density, wet processes can achieve 2.7g/cm³ or higher.

Currently, other dry process equipment in the industry reaches roughly 2.3–2.4g/cm³; our target is 2.5–2.6g/cm³.

Do not underestimate this 0.1 improvement—it is extremely challenging. Dry processes lack solvent lubrication, and strong mechanical interlocking among powders makes compaction harder. Tsingyan breaks through this 0.1 barrier via a dual approach: deep material modification and continuous equipment optimization. Achieving 2.5g/cm³ is feasible, and we are striving toward 2.6g/cm³.

For anodes, dry processes exhibit unique advantages with silicon-carbon anodes. PTFE binder forms a fibrous network—acting like microscopic "rubber bands"—which, compared to SBR’s point bonding or PVDF’s film bonding, offers superior elasticity. When silicon expands, this fibrous network effectively constrains and pulls it back, significantly enhancing structural stability during cycling

Gaogong Lithium: The removal of solvents in dry processes elevates the importance of binders, yet challenges such as poor conductivity, dispersion difficulties, and brittleness persist, limiting large-scale adoption. What specific progress has Tsingyan made in developing binders better suited for dry processes, particularly regarding cost-effective mass production?

Dr. Wang Chen: We screened over twenty binders globally and identified several capable of film formation. However, Tsingyan’s goals extend far beyond this.

Customer demands include lower binder usage and improved first-cycle efficiency. We have now reduced binder content to 0.7%. Concurrently, we introduced a superior secondary binder to mitigate lithium consumption issues.

Of course, PTFE remains the core binder—its fibrillation properties are foundational to dry film formation. We continue to optimize, seeking the optimal balance between its dosage and performance.

Gaogong Lithium: Solid-state batteries are considered a major application scenario for dry processes, with some companies focusing exclusively on this niche. What advancements has Tsingyan achieved in dry-film formation for solid-state electrolytes?

Dr. Wang Chen: We prioritize this area highly. Last year, Tsingyan recruited a U.S.-based team specializing in upstream materials for solid-state electrolytes and established an ultra-low-humidity environment with -70°C dew point at the Tsinghua Research Institute laboratory for solid electrolyte membrane R&D.

It is crucial to emphasize that Tsingyan’s core technology—powder film formation—inherently adapts to diverse material systems, including oxide and sulfide solid electrolytes. Our ultimate goal is to open-source mature, stable film-forming technologies to empower the entire solid-state battery industry.

Gaogong Lithium: We understand that the industry is currently pursuing a 20μm thickness for solid-state electrolyte membranes. What challenges does this metric pose for dry processes from your perspective?

Dr. Wang Chen: Indeed, 20μm presents a significant challenge. However, whether it can be achieved depends largely on the inherent properties of the materials themselves. Our equipment has undergone field validation across nearly 80% of enterprises in China’s solid-state battery sector—some succeed, while others do not.

From the equipment standpoint, the core challenge lies in achieving extreme precision and stability, particularly in roll gap and clearance control, where any deviation is unacceptable.

Tsingyan’s multi-stage thermoforming module technology not only pursues thinness but also prioritizes interface optimization. We have successfully reduced the porosity at the electrolyte-electrode interface to below 3%, thereby increasing ionic conductivity by an order of magnitude.

Gaogong Lithium: It appears that the success of dry processes is not merely a breakthrough in a single segment, but rather a deeply coupled process of synergistic iteration involving materials, processes, and equipment?

Dr. Wang Chen: Absolutely correct. Many mistakenly believe dry processing simply involves a few rolling equipment units—it is far more than that. Dry electrode manufacturing must be a systemic innovation where materials, processes, and equipment are tightly interlocked.

We chose to provide equipment precisely to offer partners "certainty." They can trust that Tsingyan's equipment is stable, reliable, and capable of achieving targets, allowing them to boldly explore their own processes and material formulations without falling into the "double-blind" dilemma of dual uncertainties in both equipment and materials.

Tsingyan delivers reliable, certain tools, empowering material and battery enterprises to innovate boldly. In turn, iterations in processes and equipment propel advancements in material systems.

Gaogong Lithium: In recent years, more domestic enterprises have ventured into dry process equipment, diversifying technical routes—examples include airflow pulverization and twin-screw extrusion for fibrillation. What distinguishes the uniqueness of Tsingyan's high-speed homogenized hybrid integration route? How do you ensure avoiding detours?

Dr. Wang Chen: The core of achieving PTFE fibrillation lies in high-speed shear, which can be accomplished through multiple methods. However, the choice of process directly determines the quality of the final electrode.

For example, regarding the airflow method, we believe its shear force is excessively strong and would compromise the integrity of active material particles—a scenario unacceptable to material enterprises. After twin-screw extrusion, granulation and subsequent dispersion are often required, which may introduce issues of inconsistent areal density.

Tsingyan's high-speed homogenized hybrid integration solution eliminates the granulation process and maximizes particle integrity, which is crucial for electrode performance.

It can be said that while most companies are still pursuing "completion," Tsingyan is already pursuing "perfection."

Gaogong Lithium: The industry is highly attentive to issues like roller damage encountered by Tesla during the mass production of dry-process cathodes. How does Tsingyan anticipate and circumvent similar problems through process or equipment design?

Dr. Wang Chen: That was a strategic issue in their early stage. Through extensive simulation and modeling, we discovered that relying solely on high pressure for compaction is an erroneous strategy.

Tsingyan adopts the opposite approach: high shear, low pressure. This effectively achieves film formation while avoiding excessive damage and wear to the equipment.

Gaogong Lithium: From R&D and product strategy perspectives, does Tsingyan focus more on extreme breakthroughs in single core equipment, or emphasize the integration of entire production lines and comprehensive cost optimization? How do you balance and choose between these two approaches?

Dr. Wang Chen: Our starting point is customer service and pursuing ultimate efficiency, so we emphasize "minimalism" and "integration." We aim for customers to achieve maximum functionality with the fewest machines.

For instance, our front-end hybrid homogenization integrated machine and back-end double-sided film-forming composite integrated machine. Our collaboration with Honggong and Naknor prioritizes perfecting individual machines to their extreme potential.

Building on this, Tsingyan's core value lies in achieving performance increments and seamlessly integrating these optimized machines to pursue ultimate line-wide performance and cost optimization. We pursue both, achieving balance through collaboration and integration.

Gaogong Lithium: Performance increments are the best foundation for market penetration. Looking ahead, what do you see as the market penetration path for dry processes? Will it primarily target emerging technologies like solid-state batteries and new capacity additions, or will it also actively pursue technological replacement of existing vast wet-process lines?

Dr. Wang Chen: Both paths exist, but their timelines differ.

First, next-generation battery technologies, particularly solid-state batteries, will almost inevitably adopt dry processes. Using wet processes for solid-state entails environmental and safety risks comparable to building a chemical plant.

Second comes new capacity additions. Some enterprises are already planning new production lines with dedicated space reserved for dry processes, as it significantly reduces floor space requirements.

Lastly is retrofitting existing lines in the established market. Early-generation, low-automation wet-process lines facing obsolescence could be feasibly converted to dry processes, but this represents a later phase. Currently, incremental market demand is more dominant.

Gaogong Lithium: Based on your observations, which category of customers or application scenarios currently exhibits the most urgent demand for dry technology? Or rather, which battery type (large cylindrical, prismatic, pouch) or application (power, energy storage, high-end consumer electronics) will be the primary catalyst for large-scale industrialization of dry processes?

Dr. Wang Chen: The most urgent demand undoubtedly comes from OEMs, particularly automakers. Cost is one of their core considerations, amplified by Tesla's demonstration effect, driving immense interest in dry processes. Following closely is the consumer electronics industry, known for its rapid adoption and validation of new technologies, presenting equally urgent demands for equipment upgrades.

Currently, our first-generation machines have sold approximately 15-16 units. This year, we will utilize downstream customer feedback to further optimize performance, especially focusing on areal density uniformity.

Gaogong Lithium: Synthesizing the above, what is your projection for the timeline of large-scale industrialization of dry electrode processes and equipment?

Dr. Wang Chen: Tsingyan's internal plan targets the latter half of 2026 for the construction and operation of China's first 5GWh-level dry electrode production line.

Looking at the broader industry, I personally believe 2027 will mark the inaugural year for dry electrode industrialization. At that point, we will witness more companies genuinely planning and investing in building mass production lines for dry electrodes.

Naturally, dry processes are still in the disruptive "initial innovation" phase, far from reaching their peak. Yet, I firmly believe that, much like today's wet coating machines, dry processes will eventually enter a phase of extreme innovation and become one of the mainstream technologies in the industry.

TSINGYANE& ONGOAL : Unveil Joint Venture, Aiming for Leadership in Dry Electrode Equipment

TSINGYANE& ONGOAL : Unveil Joint Venture, Aiming for Leadership in Dry Electrode Equipment

Discussing New Opportunities of Dry Electrode Technology in Solid-State Battery Industry – Dr. Wang Chen from Tsingyan Electronics Attends 2025 Gaogong Lithium Battery Summit

Discussing New Opportunities of Dry Electrode Technology in Solid-State Battery Industry – Dr. Wang Chen from Tsingyan Electronics Attends 2025 Gaogong Lithium Battery Summit

A Closer Look at Li-Ion Dry Electrode Coating Technology

A Closer Look at Li-Ion Dry Electrode Coating Technology