The future of lithium-ion battery manufacturing hinges on a critical showdown between dry-processed and solution-processed (wet) electrodes. These competing methods shape the cost, performance, and scalability of batteries powering electric vehicles (EVs), smartphones, and renewable energy storage. While solution-processed electrodes currently hold a commanding 90% market share, dry-processed electrodes are emerging as a disruptive, cost-effective alternative. Which technology will lead the charge in the battery industry? In this blog, we break down how each method works, their key differences, the advantages and challenges of dry processing, and what the future holds for battery production.

Understanding the mechanics of wet and dry electrode manufacturing is essential to evaluating their potential. Each method follows a distinct process, with significant implications for cost, efficiency, and environmental impact.

The wet electrode process, widely used by industry giants like CATL, Panasonic, and LG Energy Solution, begins with mixing active materials, binders, and solvents (typically N-Methyl-2-pyrrolidone, or NMP) into a slurry. This slurry is coated onto a current collector using techniques like slot-die or doctor blade coating, followed by drying in energy-intensive ovens to evaporate the solvents. The final step, calendering, compresses the electrode to enhance density. While precise, this method is costly and energy-heavy due to solvent handling and drying requirements.

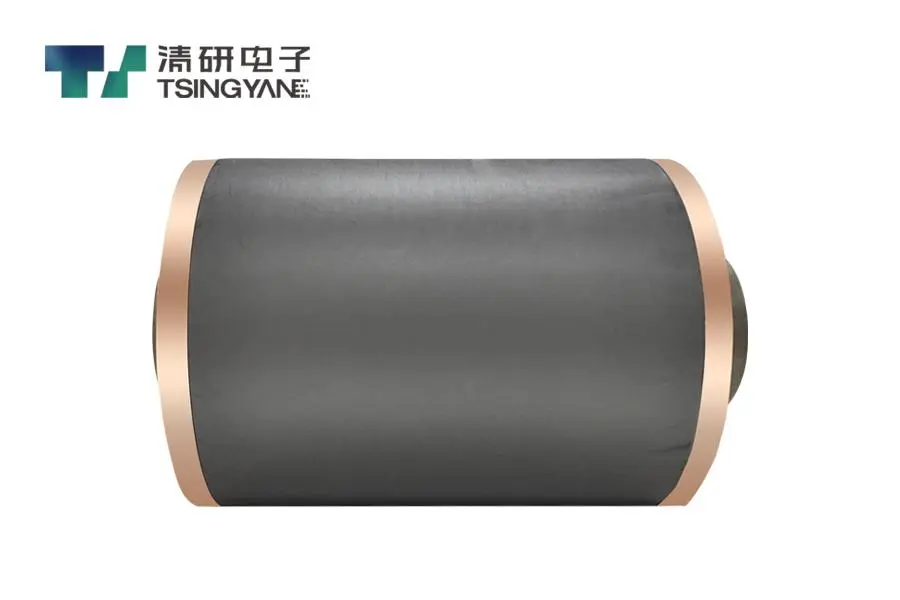

Dry electrode manufacturing, championed by Tesla (via its Maxwell Technologies acquisition), Toyota, and emerging startups, eliminates solvents entirely. It involves dry mixing powdered active materials and binders, followed by calendering or roll-to-roll pressing to form a film that is directly laminated onto the current collector. This solvent-free approach reduces energy use and simplifies production, making it a promising alternative for next-generation batteries.

The choice between dry and wet electrode processing comes down to several critical factors that influence cost, performance, and scalability.

Wet processing relies heavily on toxic solvents like NMP, while dry processing uses none, giving it a clear environmental edge. Energy consumption is another stark contrast: wet methods require long drying ovens, consuming significant power, whereas dry processing cuts energy use by 50-80%. Production speed is three to five times faster with dry methods, as they bypass the slow drying step. Cost-wise, dry processing offers 20-50% savings at scale due to lower solvent and energy expenses. However, wet processing currently excels in scalability, thanks to decades of refinement, and delivers more precise, uniform coatings compared to dry methods, which still face uniformity challenges.

Dry electrode processing is gaining traction due to its transformative benefits, particularly in cost reduction and sustainability.

By eliminating the need for expensive solvents like NMP, which costs around $50 per kilogram, dry processing avoids both purchase and recovery costs. The absence of 50-meter-long drying ovens reduces factory footprints and energy bills, as drying is the most energy-intensive step in wet processing. These efficiencies translate to estimated cost savings of 30-50% per battery, making dry electrodes a game-changer for affordable EVs.

Dry processing produces no toxic solvent emissions, unlike NMP, which is hazardous to workers and the environment. Its lower energy requirements also result in a significantly reduced carbon footprint, aligning with the push for sustainable battery production. These advantages position dry electrodes as a greener choice for manufacturers aiming to meet stringent environmental regulations.

Despite its promise, dry electrode processing faces hurdles that must be addressed to compete with the established wet method.

Achieving uniform coating and strong adhesion with dry powder is more challenging than with wet slurries, as dry mixing can lead to inconsistencies that affect battery performance. Additionally, dry processing is currently better suited for anodes than cathodes, limiting its applicability across all battery chemistries until further advancements are made.

Dry electrode manufacturing has not yet reached the massive scales required for widespread adoption, with current equipment capable of producing around 1 GWh per year. Companies like Tesla are working to scale production to 100 GWh annually, but this remains a significant challenge compared to the well-established infrastructure of wet processing.

Several industry leaders and innovators are investing heavily in dry electrode technology. Tesla, leveraging Maxwell Technologies' expertise, is deploying dry processing for its 4680 cells, aiming to revolutionize EV battery costs. Toyota is developing patented dry processes for solid-state batteries, while startups like SES AI, Enovix, and Blackstone Resources are pushing the boundaries of dry electrode innovation, signaling strong confidence in its potential.

The trajectory of dry versus wet electrode processing depends on timelines and technological breakthroughs.

In the near term, a hybrid approach is likely to prevail, with dry processing used for anodes and wet processing for cathodes due to the latter's uniformity requirements. This combination leverages the cost and environmental benefits of dry methods while relying on wet methods' proven scalability.

If uniformity and scalability challenges are resolved, dry processing could fully replace wet coating by 2030. The potential for massive cost reductions—potentially halving battery production expenses—could render wet electrodes obsolete, especially as demand for affordable EVs and energy storage grows.

Dry electrode processing offers unparalleled cost savings, environmental benefits, and production efficiency, positioning it as a formidable challenger to the dominant wet electrode method. However, wet processing's decades of refinement give it an edge in scalability and coating precision for now. As Tesla, Toyota, and innovative startups race to perfect dry electrode scaling, the company that overcomes these challenges first could redefine the battery industry. The future of batteries is leaning dry, promising cheaper, greener energy storage to power the next generation of electric vehicles and beyond.

If you are interested, there are other related dry electrode blogs:

What Is Dry Electrode Coating Technology

Dry Electrode Processing & Manufacturing

Dry Battery Electrode Technology

Dry Battery Electrode Manufacturing Process and Machine

Dry Electrode Coating Technology - DBE Battery

Dry Coating Technology & Process

Battery Electrode Foil Drying Process